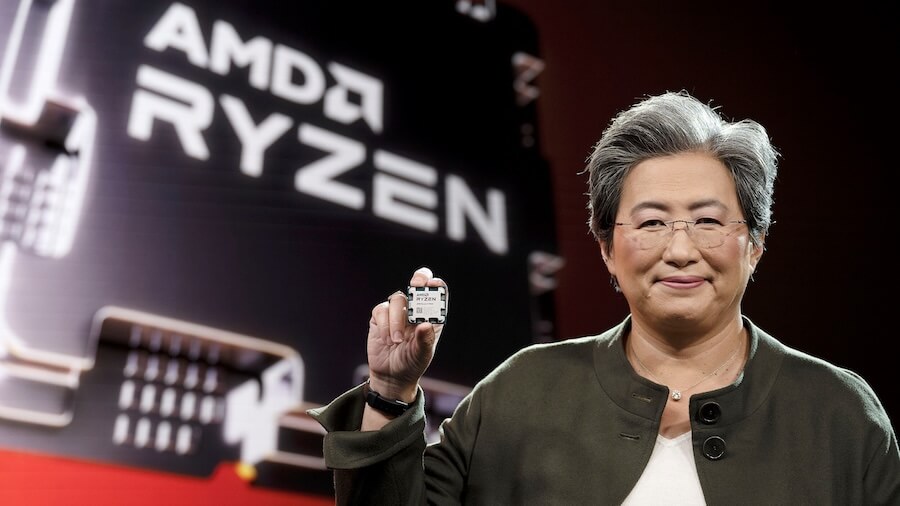

Advanced Micro Devices (AMD) announced a $6 billion share buyback Wednesday, boosting shares 6%. The authorization adds to a $4 billion existing program, with CEO Lisa Su citing confidence in AMD’s AI-driven growth and cash flow. AMD reported Q1 earnings of 96 cents per share on $7.44 billion in revenue, bolstered by a $10 billion deal to supply AI chips to Saudi Arabia’s Humain, alongside Nvidia. Bank of America raised AMD’s price target to $130, reflecting optimism. The buyback aligns with AMD’s role as a key AI chip player, second to Nvidia, amid a US-Saudi chip access deal during Trump’s Middle East tour. The Commerce Department’s rescission of AI chip export curbs further supports AMD’s global reach. However, Trump’s tariffs (30% on China) and economic uncertainty pose risks, with firms like Hertz citing tariff impacts. AMD’s stock rise contrasts with broader market caution, as 60% of Americans delay purchases, per a Harris/Guardian poll. The buyback signals robust prospects, but AMD must navigate trade volatility and competition in the AI chip race.

AMD Shares Rise 6% on $6 Billion Buyback

Related Posts

© 2025 Newsweek World.

All rights reserved.